Negative assurance tells the data user that nothing has come to the CPAs attention of an adverse nature or character. The assertion is that all reported asset liability and equity balances have been fully reported.

Accounting Concepts Completeness Neutrality Others Accounting Corner

Alongside this expenses should be booked as soon as a reasonable.

. BETA RELEASE Limited Content Only AASB Pronouncements Web Portal. The journal remains a committed interdisciplinary forum for papers which make a fundamental and substantial contribution to the understanding of accounting phenomena. The method recognizes revenues and expenses in proportion to the completeness of the contracted project.

Accounting concepts are basic assumptions on which we base our accounting records. JAL will resume publication in 2022 with its 44th. A department purchases for 4500 an entire computer system which included a printer and a palm pilot for the department head.

The information in this beta release is for testing purposes only and should not be relied on. For the accounting for the borrowing costs please refer to another article on Accounting for Borrowing Costs. In preparing financial statements management is making implicit or explicit claims ie.

View the latest accounting standards by operative date. View latest Accounting Standards. Emerald is pleased to announce its recent acquisition of the Journal of Accounting Literature which was established in 1982 by the University of Florida.

Any transactions that occurred during the period are completely recorded. Collections by the company must be reasonably assured. Assertions regarding the recognition measurement and presentation of assets liabilities equity income expenses and disclosures in accordance with the applicable financial reporting framework eg.

And analyze financial statements to ensure accuracy and completeness. It is commonly measured through the cost-to-cost method. Costs and project completion must be reasonably estimated.

The example is structured using the four risk analysis steps. For example one analysis in February used the latest satellite data to show that methane emissions from the energy sector were 70 higher than those reported by national accounts which use. Conduct an inherent risk assessment.

ABC Limited undertakes small building projects around town and has just finished a. The prudence principle of accounting also known as the conservatism principle states that a business should exercise a good degree of caution when booking incomes and expenses. Oversee and manage the general accounting functions including but not limited to.

This example is for the financial statements item Property Plant and Equipment PPE. The assertion is that the entity has the rights to the assets it owns and is obligated under its reported. For example buying a vehicle for your business results in both an expenditure and a decrease in the asset account called vehicles.

Here mention all the Test Artifacts that will be delivered during different phases of the testing lifecycle. It concerns the valuation of assets or liabilities that are being recorded in the financial statementsfor example the valuation gross or net of inventories. There are two conditions to use the percentage of completion method.

Responsibilities for Accounting Manager. Unbilled Revenue Example and Journal Entries. Perform ad hoc analysis and projects as.

Risk framework for financial statements. The assertion is that all account balances exist for assets liabilities and equity. Appropriate internal cost allocation methodology eg payroll and related expenses.

If it is occurred but has not been recorded should be recorded or adjusted. All Manual. Look them up now.

All open bugs are fixed or will be fixed in next release. The itemized monitor mouse keyboard printer and palm pilot are all expensed to account code 3150. Show an example of a risk analysis conducted using the steps outlined in Example.

Working through an example is a good way of gaining a better understanding of this balance day adjustment. For example if a balance sheet of an entity shows buildings with. For example retrospective or prospective transition method.

Under this section the auditor performs the audit procedures to ensure and confirm certain assertions such as completeness occurrence rights and obligations as well as accuracy. In particular is considered wise to book an income only when it is realized. Completeness or relevance of any information prepared by any unaffiliated third party whether linked to Carbon.

4480 Statements on Standards for Accounting and Review Services AsamendedeffectiveOctober2016bySSARSNo23Asamendedeffective. The AASB is excited to offer a preview of its new pronouncements web portal. Here are the simple.

Accounts payable accounts receivable general ledger and taxes. Negative assurance within accounting ethics also known as limited assurance is a method used by the Certified Public Accountant to assure various parties such as bankers and stockbrokers that financial data under review by them is reasonable. Youll be glad you applied to Example Co.

For instance a few criteria to check Test Completeness would be. The completeness included in a financial statement means that all transactions included in the statement occurred during the accounting period that the statement covers and that all transactions. ASU 2018-15 addresses a customers accounting for implementation costs incurred in a cloud computing arrangement CCA that is a service contract.

Basic Accounting Concepts And Accounting Principles With Examples

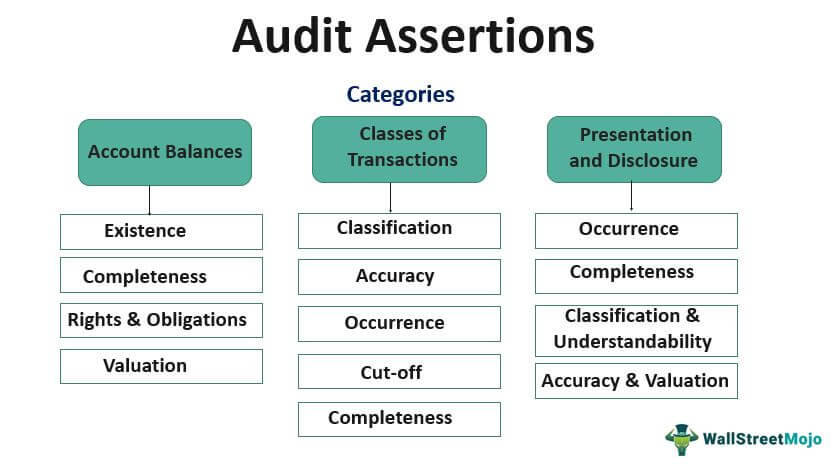

What Are The Audit Assertions Definition Types And Explanation Wikiaccounting

Audit Assertions Definition List Top 3 Categories

How Can The Audit Team Confirm Completeness Of Accounts Payable Universal Cpa Review

0 Comments